This summer, I’m working at Lauren Enright’s start-up business, Axiom Climate, as a Corporate Water Policy Research Consultant. The word “axiom” by definition is a statement which is of self-evident truth, accepted without controversy. The work Lauren and I have done so far explores some of the self-evident truths of water management and policy frameworks.

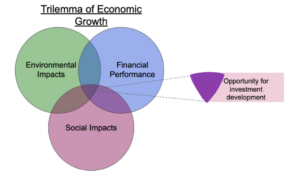

We focus on data mapping, water policy, risk management, and environmental/social/governance/diversity (ESGD) criteria. (It’s only in the last several months that the “D” has been added to ESG to prioritize justice and diversity in companies.)

At Axiom, I critique corporate water policies and make recommendations about how to recenter business models around natural resource preservation and community empowerment. Specifically, I’ve been looking at water as a socially valued resource, with nearly exhaustive social, cultural, spiritual, pragmatic meaning, as well as the way that this meaning is translated through regulatory frameworks, internal management policies, and corporate strategies.

To do this, I ask:

- How does the monetary valuation of water as a natural resource influence geo-spatial water availability?

- Who has access to water, and of what quality, and why?

- How is power transacted?

- How are meaning and power translated to a large scale that affects change at a corporate level?

- Under what conditions is comprehensive organizational change taking place?

To begin answering these questions, we have to first deconstruct an even more fundamental one: what does the network of power that dictates water resource management look like?

This power network is linked to the ESGDs, which, for a little historical perspective, are rooted in the 1970s, a period marked by emerging environmental concerns—and major environmental legislation—in the US.

In their infancy, ESG criteria were used only by select investors. However, research over the past 50 years has documented a positive relationship between well performing ESG requirements and corporate financial performance (CFP) (Friede, Busch, & Bassen; 2015).

The purpose of ESGDs, then, is to pivot the market segment towards addressing human and environmental concerns, such as human rights and climate change.

However, our initial research in the food and beverage sector has suggested otherwise. Within the food and beverage sector, the agriculture sector was a good place for us to start. It’s the largest global employer, making up ~26% of employment and using 70% to 90% of global freshwater (Weber & Saunders-Hogberg, 2018).

Although the food and beverage industry consumes a significant amount of water, a study found that of the 61 companies analyzed, only 28.7% measured their ecosystem impact (Weber & Saunders-Hogberg, 2018). Further, it was suggested that when Corporate Social Responsibility (CSR) is accounted for within the food and beverage industry, it is motivated by supply chain management, profit maximization, and institutional pressure, rather than the intrinsic value of water, ecosystems, or the people that depend on both (Weber & Saunders-Hogberg, 2018).

Where do we go from here?

The Axiom team met up on the harbor of Beverly, MA this week to discuss what this all meant and to plan on how we were going to move forward with our work, which had seemed to be cemented under a structure that polarized communities and power. How would Axiom fill that space? What would an ideal water framework look like? What was

needed and how could we provide it?

To answer these, our next steps will include reviewing reactionary politics and actor network theory to better understand our global water scenario, and to inform our projects moving forward. We will continue to analyze the food and beverage industry, while beginning to look at empathy mapping, environmental development and social trauma, and the Global Reporting Initiative. Further, we are planning on meeting with a Bard MBA alumni, who now is working at Ceres, where we’ll discuss supply chain management, data needs, and water mapping.

The work that I’ve done at Bard Center for Environmental Policy has given me the skills necessary

to follow through with these next steps at Axiom. Specifically, the ability to conduct policy reach was integral to Bard’s Environmental and Climate Policy courses, and is a skill that I depended on heavily at Axiom. Likewise, this invaluable professional experience will support my thesis work in the spring.

References:

Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233, DOI: 10.1080/20430795.2015.1118917

Weber, O., & Saunders-Hogberg, G. (2018). Water management and corporate social performance in the food and beverage industry. Journal of Cleaner Production, 195, 963–977. https://doi.org/10.1016/j.jclepro.2018.05.269